Little Known Questions About Clark Wealth Partners.

An Unbiased View of Clark Wealth Partners

Table of ContentsUnknown Facts About Clark Wealth PartnersClark Wealth Partners - An OverviewSome Known Factual Statements About Clark Wealth Partners All About Clark Wealth PartnersClark Wealth Partners - Questions

Basically, Financial Advisors can tackle component of the responsibility of rowing the watercraft that is your economic future. A Financial Consultant ought to function with you, except you. In doing so, they must function as a Fiduciary by putting the most effective passions of their clients above their very own and acting in great faith while providing all pertinent truths and staying clear of disputes of interest.Not all relationships achieve success ones though. Potential downsides of working with an Economic Consultant consist of costs/fees, high quality, and possible abandonment. Disadvantages: Costs/Fees This can conveniently be a favorable as high as it can be an adverse. The trick is to make sure you obtain what your pay for. The saying, "cost is an issue in the lack of value" is exact.

Disadvantages: High Quality Not all Monetary Advisors are equivalent. Just as, not one consultant is excellent for every possible client.

Not known Facts About Clark Wealth Partners

A client should always be able to answer "what happens if something occurs to my Financial Consultant?". It starts with due persistance. Always correctly vet any type of Financial Advisor you are pondering collaborating with. Do not rely upon ads, awards, qualifications, and/or referrals entirely when looking for a connection. These means can be used to limit the pool no doubt, yet then gloves require to be put on for the rest of the job.

If a certain location of competence is required, such as functioning with executive comp strategies or establishing up retired life strategies for small service proprietors, locate experts to interview who have experience in those arenas. Working with a Monetary Consultant must be a partnership.

It is this sort of initiative, both at the start and with the connection, which will aid emphasize the benefits and hopefully decrease the disadvantages. Really feel totally free to "swipe left" sometimes prior to you finally "swipe right" and make a solid connection. There will certainly be an expense. The function of a Monetary Advisor is to aid customers establish a plan to fulfill the financial objectives.

It is essential to comprehend all costs and the framework in which the advisor operates. The Financial Advisor is accountable for giving worth for the fees. https://www.discogs.com/user/clarkwealthpt.

The Main Principles Of Clark Wealth Partners

Preparation A business strategy is crucial to the success of your business. You need it to recognize where you're going, exactly how you're arriving, and what to do if there are bumps in the road. A good economic consultant can create a comprehensive plan to assist you run your company a lot more effectively and plan for anomalies that emerge.

Reduced Tension As a company owner, you have whole lots of things to stress around. An excellent monetary expert can bring you tranquility of mind knowing that your finances are obtaining the interest they require and your money is being spent intelligently.

Sometimes company proprietors are so concentrated on the daily grind that they shed view of the big image, which is to make an earnings. A financial consultant will certainly look at the overall state of your financial resources without obtaining feelings involved.

The Clark Wealth Partners PDFs

There are numerous advantages and disadvantages to think about when hiring an economic advisor. Firstly, they can supply beneficial proficiency, specifically for complicated financial planning. Advisors offer individualized techniques customized to specific goals, possibly resulting in far better financial end results. They can likewise relieve the tension of taking care of investments and economic decisions, giving peace of mind.

The cost of hiring an economic expert can be significant, with fees that may influence total returns. Financial planning can be frustrating. We suggest speaking with a financial consultant.

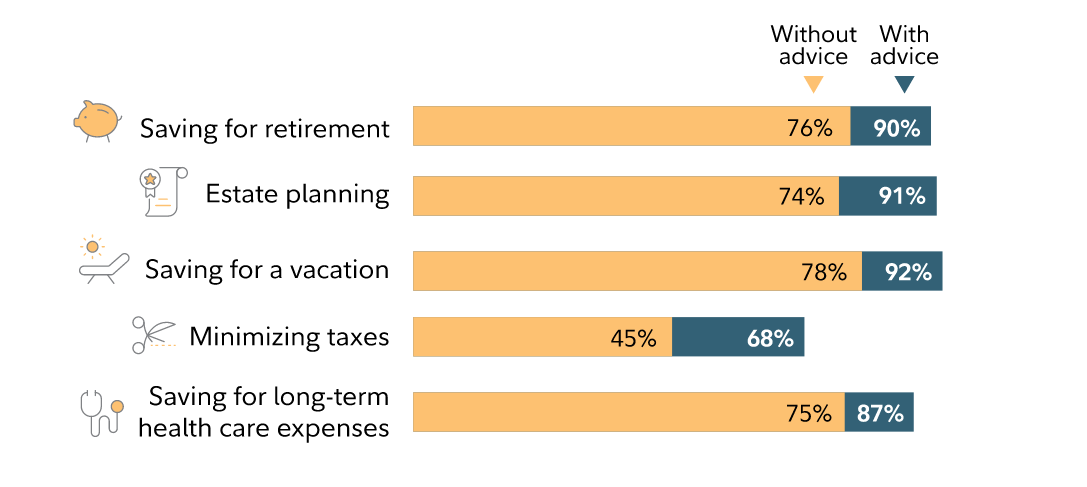

Discover Your Advisor Individuals transform to financial experts for a myriad of reasons. The prospective benefits of working with a consultant include the expertise and knowledge they offer, the tailored guidance they can provide and the long-lasting self-control they can inject.

Fascination About Clark Wealth Partners

Advisors learn experts that remain updated on market trends, investment approaches and financial regulations. This understanding allows them to give insights that might not be readily obvious to the typical individual - https://www.slideshare.net/ClarkWealthPartners?tab=about. Their competence can assist you navigate complex economic scenarios, make educated choices and potentially exceed what you would certainly achieve by yourself